child tax credit october 2021 schedule

How much is the child tax credit worth. The chart below shows the maximum tax credit you can claim based on the childs age.

Did You File An Extension For Your Individual Tax Return You Have Until October 15 2021 To File Your In 2021 Accounting Services Small Business Accounting Irs Taxes

The Child Tax Credit has been sent out since July and it has been.

. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. October 15 2021 1242 PM CBS Chicago. For each child under age 6 and.

Part of the American Rescue Plan eligible parents can get half of their allowance before the end of 2021 and the. Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. Taxpayers should refer to Schedule 8812 Form 1040.

The 500 nonrefundable Credit for Other Dependents amount has not changed. Eligibility is based on your childs age at the end of this calendar year. Eligible families can receive advance payments of.

To reconcile advance payments on your 2021 return. The IRS is relying on bank account information provided by people through their tax. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Schedule 8812 Form 1040 is now used to calculate child tax credits and to report advance child tax credit payments received in 2021 and to figure any additional tax owed if excess advance child tax credit payments. What is the schedule for 2021. The deadline for the next payment was October 4.

When you are self employed and report this income on an IRS Schedule C the Net Income ie. Ad The new advance Child Tax Credit is based on your previously filed tax return. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. For each child age 6 and above. CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15.

The advance is 50 of your child tax credit with the rest claimed on next years return. Payments start July 15 2021. 112500 for a family with a single parent also called Head of Household.

Child Tax Credit Payment Schedule for 2021. These changes reflect that Publication 972 Child Tax Credit has become obsolete. By August 2 for the August.

Three payments of the credit have already been sent out and three more are to come in 2021 with the next one due on October 15. October 29 2021. This years Tax Day falls on April 18 2022.

Families now receiving October Child Tax Credit payments. 3600 for children ages 5 and under at the end of 2021. The schedule of payments moving forward will be as follows.

Up to 250 per month. Up to 300 per month. The complete 2021 child tax credit payments schedule.

The expansion has increased the amount for children age 0 through 5 and children ages 6 through 17. In October the IRS delivered a fourth monthly round of approximately 36 million. Up to 300 dollars or 250 dollars depending on.

The Child Tax Credit provides money to support American families. The actual time the check. Get your advance payments total and number of qualifying children in your online account.

The schedule of payments moving forward is as follows. That means all qualifying children there are other requirements we explain below born. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

150000 for a person who is married and filing a joint return. In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. The payments will be paid via direct deposit or.

Enter your information on Schedule 8812 Form. 3000 for children ages 6 through 17 at the end of 2021. Eligible families began to receive payments on July 15.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The IRS will send out the next round of child tax credit payments on October 15. Before 2021 the child tax credit was worth 2000 for children age 0 through 16.

Payments begin July 15 and will be sent monthly through December 15 without any further action required. Here is some important information to understand about this years Child Tax Credit. 2021 Advance Child Tax Credit.

The complete 2021 child tax credit payments schedule. It also made the. The payments will be paid via direct deposit or check.

Each payment will be up to 300 for each qualifying child under the age of 6 and. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Subsequent opt-out deadlines for future payments will occur three days before the first Thursday of the month from which a person is opting out.

Up to 300 dollars or 250 dollars depending on age of child August 15 PAID.

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Schedule 8812 H R Block

2021 Child Tax Credit Advanced Payment Option Tas

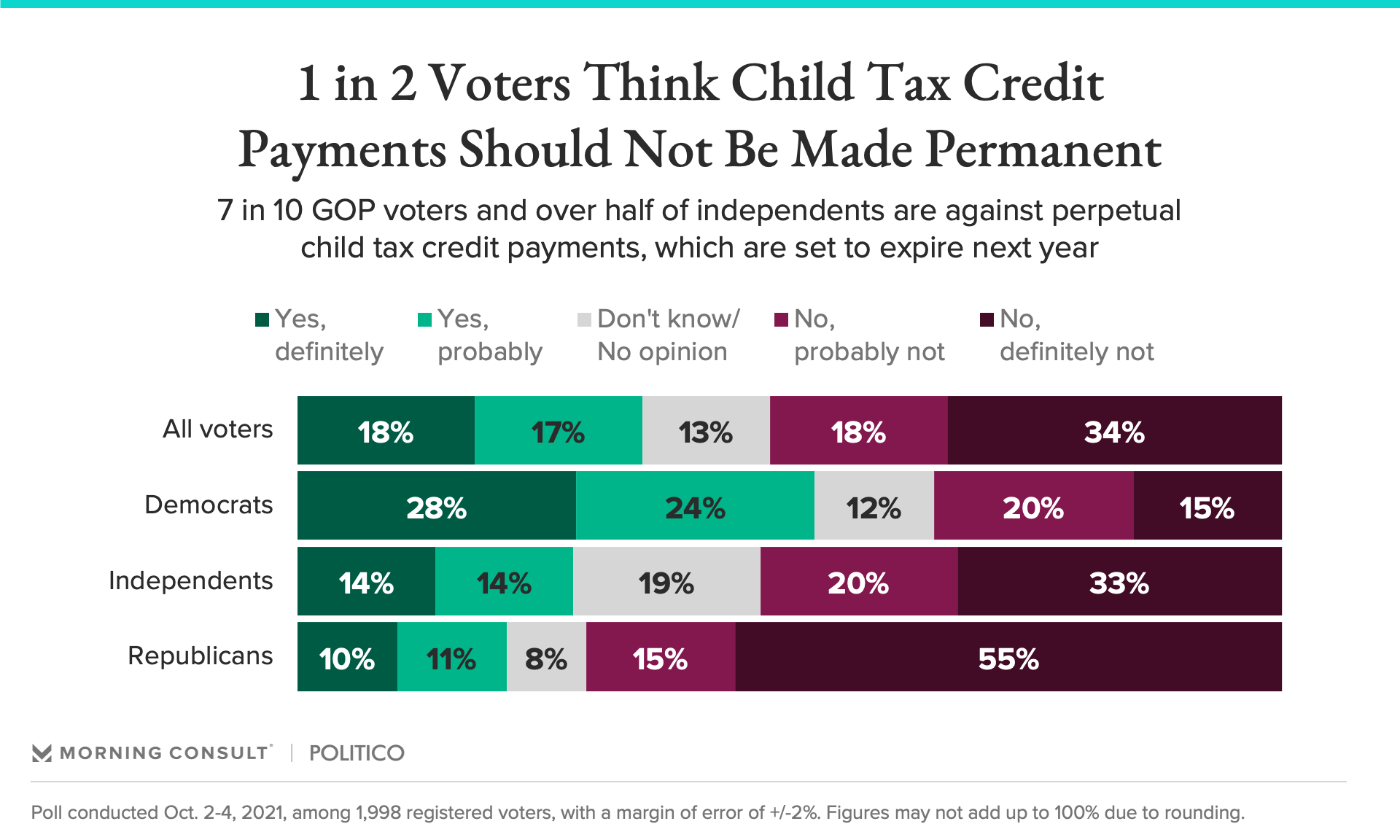

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Child Tax Credit 2021 8 Things You Need To Know District Capital

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

What Families Need To Know About The Ctc In 2022 Clasp

Expiration Of Child Tax Credits Hits Home Pbs Newshour

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 Payment Schedule Nine States Are Offering Checks Up To 1 000 Is Yours Giving Extra Cash

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Childctc The Child Tax Credit The White House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet